Rebirth S.p.A. annonce le lancement d’une augmentation de capital, avec droit d’option, d’un montant maximum de 6,4 millions d’euros, pour accompagner le plan de développement 2025-2028

26 janvier 2026Rebirth S.p.A. – Forte croissance en 2025 : valeur de la production +23 %

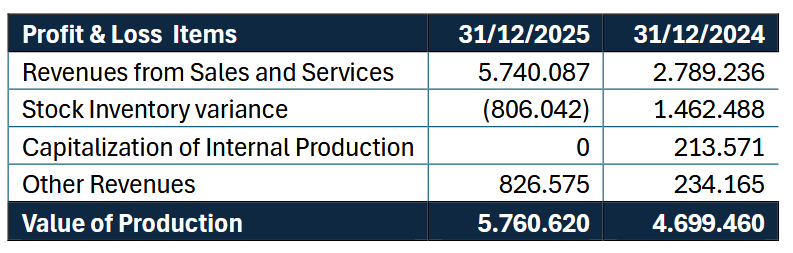

Formello, 2 Febbraio 2026 – Rebirth S.p.A. (ISIN Code: IT0005460081 – Ticker: ALREB), a dynamic company, specialized in the development and management of real estate assets, listed on the Euronext Growth Paris market, announces the generation of strong revenue growth at the end of the 2025 financial year, with the completion of the transition from a focused real estate company to an integrated sector operator. The consolidated Value of Production as at 31 December 2025 stood at 5,760,620 euros, up compared to 4,699,460 euros in 2024 (+23%).

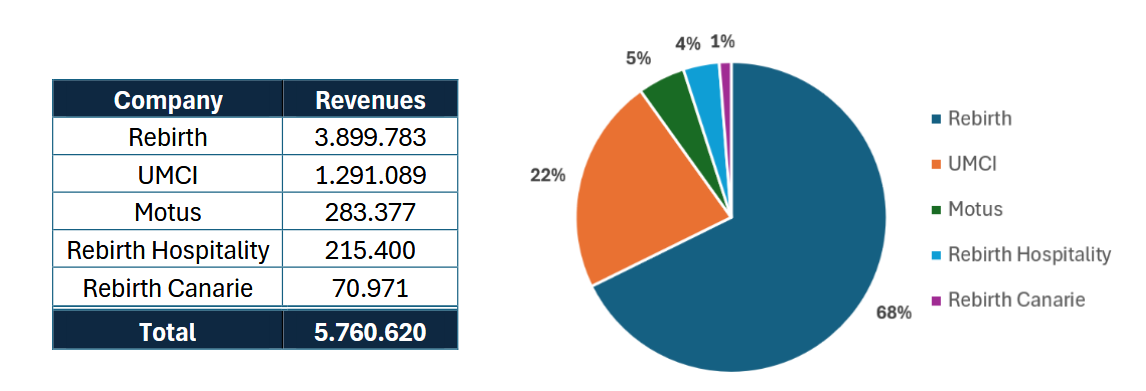

A significant figure not only for the absolute increase, but also for the change in the scope of consolidation: while the 2024 figures referred exclusively to the parent company Rebirth S.p.A., 2025 represents the first year of consolidated reporting, with the formal entry of companies such as UMCI (credit mediation), Motus (technical maintenance), Rebirth Hospitality (tourism) and Rebirth Canarie.

However, it should be noted that, although not consolidated in 2024, the companies now part of the Group did not yet generate economically significant volumes at that date. As a result, the comparison also remains significant from the point of view of economic substance.

GROWTH IN REVENUES, OTHER COMPONENTS AND INTEGRATION OF THE PERIMETER

2025 recorded strong growth in revenues from sales and services, which rose to 5,740,087 euros, more than doubling compared to the 2024 figure (2,789,236 euros, referring to Rebirth S.p.A. alone).

This figure includes income from:

• real estate development and construction activities;

• management of income properties;

• selective disposal of non-core assets;

• credit brokerage;

• maintenance and facility management;

• activities in the tourism-accommodation sector.

In particular, the positive contribution of the companies acquired or established during 2024 is highlighted:

FOCUS ON THE VALUE OF PRODUCTION: EFFECTS OF INVENTORIES AND CAPITAL GAINS

The overall Value of Production takes into account not only sales and service revenues, but also changes in inventories, which in 2025 had a negative impact of -806,042 euros, against a positive impact in 2024 of over 1.46 million. This negative effect is physiological in a phase of construction progress, and reflects the transformation of work in progress into actual revenues.

This impact was offset by strong growth in Other Revenues, which rose from €234,165 to €826,575, thanks to:

• capital gains from selective asset disposal transactions;

• contributions and ancillary revenues related to ordinary activities;

• effects related to extraordinary transactions.

REBIRTH S.P.A.: REAL ESTATE CORE ALWAYS CENTRAL

The parent company Rebirth S.p.A. closed 2025 with revenues of 3,899,783 euros, and the main drivers were:

• the sale selected properties as an integral part of the asset rotation strategy;

• the increase in the volume of leased properties;

• the progress of the construction sites envisaged in the development plan, which have produced progressive revenues.

INTEGRATION OF THE GROUP PERIMETER: PERFORMANCE BEYOND EXPECTATIONS

The year also marked the first full year of consolidation of UMCI, which recorded over 1.29 million euros in revenues, confirming the potential of the credit brokerage sector integrated with real estate. Motus, active in maintenance and technical management, generated 283,377 euros, becoming, following the acquisition of the remaining 50% of the property as announced with press release on 4th April 2025, the internal hub for operational efficiency on the Group’s properties. In the tourism sector, the newly established Rebirth Hospitality has started the first operational activities related to the management of the assets owned by the group, recording 215,400 euros in revenues, with excellent visibility for 2026 when the progressive management of existing accommodation facilities as well as those under development will be assigned.

The foreign subsidiary Rebirth Canarie, the company responsible for Rebirth’s development in the Canary Islands, has regularly continued its activity on projects already operational, 2026 should mark the year in which the development plans for the country will take shape and then expand the focus on a third foreign country, as envisaged by the Group’s strategy.

OUTLOOK 2026 AND UPCOMING EVENTS

For 2026, Rebirth aims to consolidate operating margins, complete the integration of subsidiaries, and enhance the assets and initiatives in the pipeline, including construction, hospitality and other investments.

As for the upcoming events, Rebirth communicates the 2026 Financial Calendar:

• Publication of 2026 Full Year Balance Sheet and Consolidate Balance Sheet: April 15, 2026

• Annual General Shareholders’ Meeting: April 30, 2026

• Communication of 2026 First Half Revenues: July 31, 2026

• Publication of 2026 First Half Balance Sheet and Consolidate Balance Sheet: October 30, 2026

This press release is available on the www.re-birth.it website and on the Euronext platform.