Avis de changement important dans la composition des principaux actionnaires

11 septembre 2025Rebirth S.p.A. annonce le lancement d’une augmentation de capital, avec droit d’option, d’un montant maximum de 6,4 millions d’euros, pour accompagner le plan de développement 2025-2028

26 janvier 2026Rebirth Group: Forte croissance du chiffre d’affaires et amélioration opérationnelle au premier semestre 2025

Formello, 30 October 2025 – Rebirth S.p.A. (ISIN Code: IT0005460081 – Ticker: ALREB), a dynamic company, specialized in the development and management of real estate assets, listed on the Euronext Growth Paris market, announces the results of the Consolidated Financial Statements prepared for the First Half of 2025, and the prospects for the future.

The Board of Directors of our company, a listed company active in real estate development and in the management of tourist-accommodation facilities, has prepared and approved the Financial Statements in the Consolidated version for the first time, on the occasion of the close of the First Half of 2025, considering the rapid expansion of the group perimeter, and the increase in operating activities.

Strong growth in economic and financial results

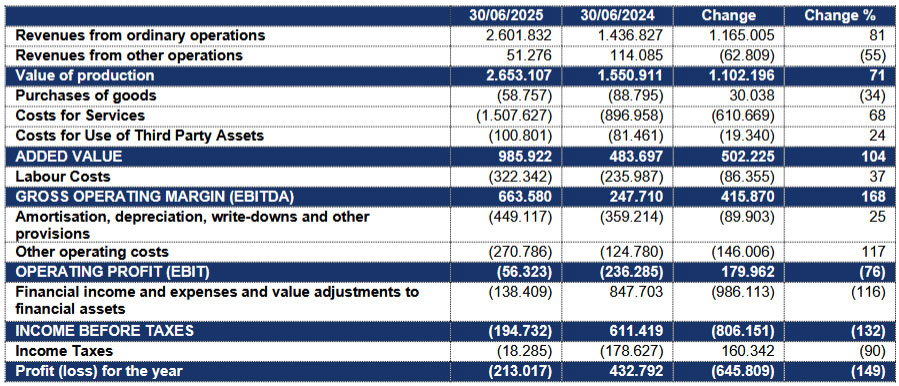

The Rebirth Group ended the first half of 2025 with a Consolidated Value of Production of EUR 2.65 million,, up 71% from the EUR 1.55 million recorded on 30 June 2024. The result confirms the solidity of the organic growth and the effectiveness of the expansion and integration strategy of the Group’s operating companies.

Revenues from sales exceeded €3.51m, up +240% compared to 2024, thanks to the growing contribution of the real estate divisions, particularly property sales, as per the business plan, and services.

The negative change in inventories (-0.9 million) reflects the natural progress of real estate projects, as well as the aforementioned disposals.

On the cost’s side, the increase in services (+68%) and labour costs (+37%) is consistent with the enlargement of the operating perimeter and the start-up of new lines of business, while maintaining a clearly improved industrial margin.

Gross Operating Margin (EBITDA) closes at €663,000, compared to €248,000 in H1 2024 (+168%), confirming the structural strengthening of profitability.

Operating profit (EBIT) migliora sensibilmente, passando da EUR -236,000 to EUR -56,000, marking a recovery of 76% thanks to greater management efficiency and the containment of non-recurring costs.

Pre-tax profit closes at -€195,000, compared to +€611,000 in 2024. The comparison, however, was affected by the presence in the 2024 financial statements of an extraordinary financial income from a capital gain realised on the sale of a non-strategic equity investment, which had a significant impact on the result for that year.

Adjusted for this extraordinary effect, the 2025 Balance Sheet shows a real and structural operational improvement.

Fiancial Strenght and structural growth

Total Assets remained substantially stable at EUR 40.26 million, with an increase in fixed assets to EUR 30.38 million (+1.8%), in particular tangible fixed assets related to the increase in real estate, and a strengthening of trade receivables (+42.6%). Consolidated shareholders’ equity grew to 29.4 million (+1%), confirming the Group’s financial solidity and ability to support new investments thanks to contributions from existing and new shareholders.

Performance by operating segment

- Real Estate (Rebirth S.p.A.) – The Group’s leading sector, with a Value of Production of EUR 2.19 million (+74%) and EBITDA up 61%, to EUR 563 thousand. The results reflect the valorisation of assets and the full operation of ongoing projects.

- Maintenance (Motus S.r.l.) – Improved profitability with a positive EBITDA of EUR 77 thousand, compared to a loss of EUR 77 thousand in 2024, due to optimisation of orders and more efficient cost management.

- Tourism and Foreign Hospitality (Rebirth Canary Islands, Gold Drake, Rebirth Hospitality) – Activities show a gradual improvement: Rebirth Canary Islands reduces operating losses from – €21 thousand to -€4 thousand; Gold Drake remains in balance; Rebirth Hospitality, a vehicle created to manage domestic Hospitality activities, has started to acquire the first assets under management, achieving a Value of Production of €62.9 thousand and a GOP close to breakeven.

- Credit brokerage (UMCI) – A sector in which Rebirth sees valid and important synergies by investing in the purchase of 60% of the shares of the company UMCI Srl, recorded a Value of Production of Euro 255 thousand and a positive EBITDA of Euro 4.7 thousand, supported by commercial expansion and partnerships in the financial sector.

- Call centre (Bienestar Canarias) – margin just positive with a gross operating profit of EUR 436 and Value of Production of EUR 38 thousand, benefiting from an operational reorganisation and greater management efficiency.

Statement from the Chief Executive Officer

« The first half of 2025 confirms the growth trajectory of the Rebirth Group, with strongly improving operating results and a significant expansion of the perimeter, » said Massimiliano Alfieri, CEO of Rebirth S.p.A. « This year’s results demonstrate a real strengthening of the group’s profitability and solidity. 2025 marks the beginning of a new phase of consolidation and development of our activities in Italy and abroad. »

Outlook for the second half of 2025 and subsequent years

Looking ahead to the second half of 2025 and beyond, the Rebirth Group is moving with confidence and strategic vision in its operating segments, also leveraging favorable market trends described by specialized sources. The main guidelines for each area are as follows:

- Real estate: the Italian real estate market is expected to progress, supported by lower interest rates, a recovery in investor confidence and strong interest in core and value-add assets. In this context, Rebirth confirms its objective to further enhance its portfolio, increase the use of real estate in an operational way and seize development opportunities in areas of high demand.

- Maintenance: the strengthening of this activity, which was already improving in the first half of the year, is supported by a growing demand for technical and maintenance services linked to the type of buildings and

structures of the Group and others. Although there is no specific sector forecast at national level, the trend towards the enhancement of real estate and tourism assets supports the growth potential of this division. - Tourism / tourism management abroad: according to the analyses, the Italian tourism sector – and more generally of Southern Europe – is destined for a strong recovery. Rebirth therefore intends to accelerate its international presence, focusing on operational efficiency, digitization of services and an integrated hospitality offer to seize what is proposed as a record year for tourism.

- Credit brokerage and financial services: the business will benefit from an Italian macroeconomic context that sees consumption and domestic demand moderately growing (+0.6% of GDP expected in 2025) and an expansion of intermediation and financial support needs.

- Call centers and external services: the moderate growth in international volumes and the demand for qualified outsourcing make the scenario favorable for this activity. However, the Group, as part of a process aimed at the sale of non-core assets, proceeded, in the period following the balance sheet closure, with the sale and enhancement of its stake in the company Bienestar Canarias SL.

- Health/biotech investment: although in the development phase, the health sector remains one of the Group’s strategic sectors for the medium to long term. Also here, since this is a non-strategic investment by virtue of the nature of the Group, the investment held in Stemway Biotech Ltd was sold in the period following the end of the financial statements.

With these prospects, the Rebirth Group focuses on the priority of consolidating the operational improvements already achieved, optimizing the cost structure, and expanding high-potential businesses, in line with a macroeconomic and market context that offers positive ideas in the medium-term.